IREN (IREN)·Q2 2026 Earnings Summary

IREN Plunges 24% as Revenue Misses by 18%, Despite $3.6B GPU Financing Win

February 5, 2026 · by Fintool AI Agent

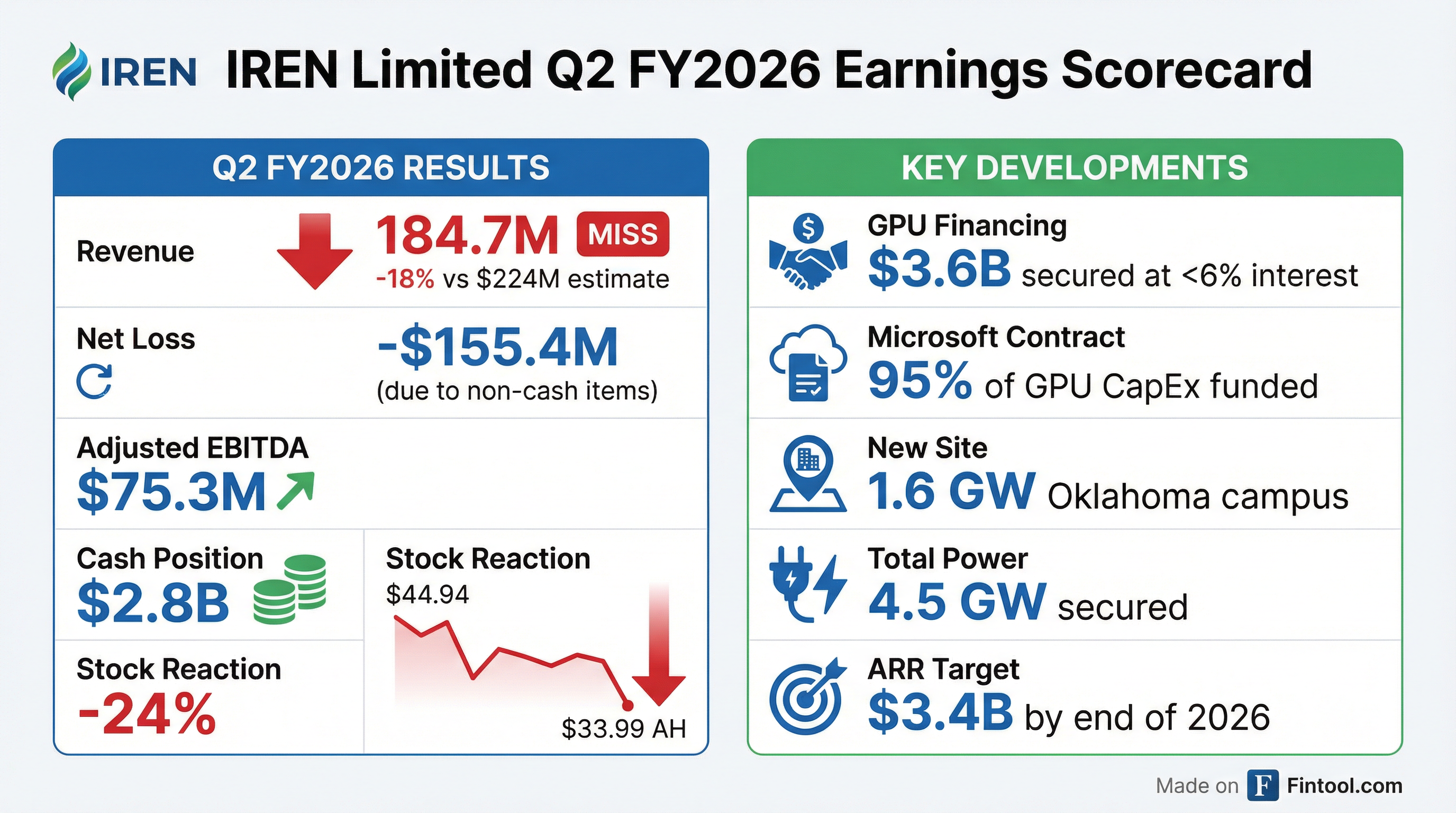

IREN Limited reported Q2 FY2026 results that sharply disappointed investors, with revenue of $184.7 million missing consensus estimates of ~$224 million by 18% . The stock cratered 11.5% during regular hours and extended losses to 24% in after-hours trading, falling to $33.99 from a pre-earnings close of $44.94 .

The quarter's headline numbers were significantly impacted by IREN's aggressive pivot from Bitcoin mining to AI cloud infrastructure, resulting in a net loss of $155.4 million driven by $219 million in non-cash charges . Despite the earnings miss, the company announced a major strategic milestone: securing $3.6 billion in GPU financing at less than 6% interest to support its $9.7 billion Microsoft contract .

Did IREN Beat Earnings?

No. IREN missed both revenue and earnings estimates substantially.

Revenue declined 23% sequentially from $240.3 million in Q1 FY2026, primarily due to lower Bitcoin mining revenue as the company accelerated its transition to AI cloud . Key impacts included:

- $107.4 million unrealized loss on financial instruments

- $111.8 million debt conversion inducement expense

- $31.8 million impairment of assets

- $99.2 million depreciation and amortization

How Did the Stock React?

IREN shares experienced one of the worst single-day declines in its history following the earnings release:

The selloff came despite several positive strategic developments, suggesting investors were focused on the near-term revenue shortfall rather than the long-term AI infrastructure buildout.

What Did Management Guide?

Management maintained its ambitious growth targets despite the revenue miss:

Key guidance commentary from CEO Dan Roberts:

"We are still at an early stage of monetization relative to the size of our platform. With more than 4.5 gigawatts of power and only 10% required to support the $3.4 billion in ARR, we have a clear pathway for continued growth."

What Changed From Last Quarter?

Capital & Financing

Power & Capacity

Revenue Mix

Q&A Highlights

On ERCOT Batch Processing (Sweetwater):

"The 2,000 MW is secure. Like, none of this batch stuff, none of the market chatter is influencing whether or not this 2,000 MW is available. We've got the signed interconnection agreement. It was signed in 2023." — CEO Dan Roberts

On Cloud vs. Colocation Strategy:

"Time to data center has become the key decision point in many of these commercial discussions... Every incremental 200 MW can deliver either $300 million-ish through a colocation or multiples of that in the billions under a cloud contract." — CEO Dan Roberts

On GPU Financing Economics:

"We essentially got the GPUs for next to nothing. So I think in terms of capital intensity, it ticks that box." — CEO Dan Roberts

On NVIDIA Relationship:

"I'd encourage it to be a safe assumption that we are having a very similar, if not exact same dialogue with all these different counterparties about different structures." — CEO Dan Roberts on credit backstops

Segment Performance

Revenue Breakdown

IREN operates two primary revenue streams during this transition period:

The AI Cloud segment more than doubled QoQ, showing strong momentum even as Bitcoin mining revenue declined due to the strategic pivot .

Revenue from AI cloud is expected to accelerate as GPU deployments ramp throughout 2026, with the Microsoft contract revenues beginning in Q2 CY2026 .

Power Portfolio

Capital & Liquidity

IREN ended Q2 with a significantly strengthened balance sheet:

Funding Sources (FY-to-date):

- Customer prepayments (Microsoft)

- $2.3B convertible notes (December 2025)

- GPU leasing arrangements

- $3.6B GPU financing (Goldman Sachs / JPMorgan)

Forward Catalysts

Key Risks Flagged

- Revenue Transition Volatility: Bitcoin mining revenue declining faster than AI cloud revenue ramping

- Execution Risk: Scaling 140,000 GPU deployment across multiple sites

- ERCOT Regulatory: Batch processing rules could affect timing (though management says power is secure)

- Non-Cash Volatility: Derivative and convertible note mark-to-market swings obscuring operating results

Management Credibility Check

Management has consistently delivered on construction timelines and capacity expansion targets. The Microsoft contract and GPU financing represent meaningful execution wins, though the revenue transition remains bumpy.

Bottom Line

IREN's Q2 FY2026 was a tale of two stories: a significant near-term revenue miss that spooked investors (-18% vs consensus, stock down 24%), but meaningful strategic progress on the AI cloud transformation ($3.6B financing, 4.5 GW power, $2.3B ARR contracted).

The question for investors is whether the market is overreacting to transitional noise or correctly pricing execution risk. With Microsoft revenue starting in Q2 CY2026 and $3.4B ARR targeted by year-end, the next two quarters will be critical for proving out the thesis.

Data sourced from IREN Q2 FY2026 earnings call transcript and S&P Global.